How To Invest In Venture Capital – Detailed Guide In 2023

Venture capital (VC) investment offers a unique opportunity for investors to participate in the growth of innovative startups. While it can be a high-risk, high-reward strategy, successful venture capital investments have the potential for substantial returns.

In this article, we will delve into the world of venture capital and provide you with a comprehensive guide on how to invest wisely in this exciting asset class.

Table of Contents

Understanding Venture Capital:

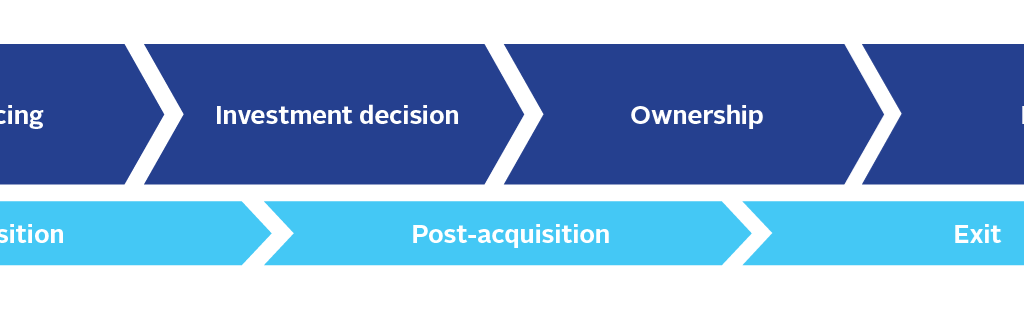

Venture capital is a form of private equity financing that investors provide to startups and small businesses with significant growth potential. These investments typically occur in the early stages of a company’s development, often before it goes public or gets acquired by a larger corporation.

Venture capitalists, or VC firms, pool money from various investors and deploy it into a diversified portfolio of startups. In return, they receive equity stakes in these companies. The ultimate goal is to support and nurture these startups, helping them grow and succeed while realizing substantial returns on investment.

Steps to Invest in Venture Capital:

Assess Your Risk Tolerance: Before venturing into the world of venture capital, it’s crucial to evaluate your risk tolerance. VC investments can be highly volatile and illiquid, meaning your money may be tied up for several years. Ensure you can afford to allocate a portion of your investment portfolio to this asset class without jeopardizing your financial stability.

Educate Yourself: Gain a deep understanding of the venture capital landscape. Study the industry, the typical stages of startup development (seed, early-stage, and growth-stage), and the key players involved. Read books, attend seminars, and follow reputable sources of information to stay informed about the latest trends and opportunities.

Diversify Your Portfolio: Like any investment, diversification is crucial to manage risk. Consider investing in venture capital through a professionally managed fund or by creating your own diversified portfolio of startups. Diversification can help mitigate the impact of any single investment’s failure.

Network and Build Relationships: Building a network in the venture capital ecosystem is essential. Attend industry events, join investment groups, and connect with experienced investors and entrepreneurs. These connections can provide valuable insights and access to promising investment opportunities.

Choose Your Investment Vehicle: There are several ways to invest in venture capital:

Venture Capital Funds: Invest in professionally managed VC funds. These funds pool money from multiple investors to invest in a diversified portfolio of startups. You can choose funds that align with your investment goals and risk tolerance.

Angel Investing: Become an angel investor by directly investing in startups. This approach offers more control but requires a deep understanding of the startup ecosystem and a willingness to actively support portfolio companies.

Crowdfunding Platforms: Some online platforms allow you to invest in startups through crowdfunding. These platforms provide opportunities to invest smaller amounts in a range of startups.

Conduct Due Diligence: Thoroughly research potential investments. Evaluate the startup’s business model, management team, market opportunity, competitive landscape, and financials. Due diligence is critical to making informed investment decisions.

Stay Informed and Engaged: Once you’ve invested in venture capital, stay engaged with your portfolio companies. Attend shareholder meetings, provide mentorship and support, and keep abreast of their progress.

Be Patient: Venture capital investments are typically long-term commitments. It may take several years for a startup to reach a liquidity event, such as an IPO or acquisition. Be prepared for a longer investment horizon.

Evaluating Investment Opportunities:

When it comes to venture capital, not all investment opportunities are created equal. To make informed decisions, you must thoroughly evaluate potential investments. Here are some aspects to consider:

Market Opportunity: Assess the size, growth rate, and potential of the market the startup operates in. A large and expanding market can significantly enhance a startup’s growth potential.

Team and Leadership: Examine the startup’s management team. Look for experienced and visionary leaders with a track record of success. Strong leadership is often a critical factor in a startup’s success.

Business Model: Understand the startup’s business model and how it plans to generate revenue. Evaluate the scalability and sustainability of the business model.

Competitive Landscape: Analyze the competitive landscape to determine if the startup has a unique value proposition or competitive advantage. Consider how the startup plans to differentiate itself.

Financials: Review the startup’s financial statements, including revenue, expenses, and projections. Assess the burn rate (how quickly the startup is using its capital) and the path to profitability.

Exit Strategy: Understand the startup’s exit strategy. How does it plan to provide returns to investors? Common exit options include initial public offerings (IPOs) and acquisitions.

Managing Risk:

Venture capital investments are inherently risky. While they offer the potential for high returns, there’s also a significant risk of losing your investment. Here are some strategies to manage risk:

Diversification: As mentioned earlier, diversify your venture capital investments to spread risk across multiple startups. Avoid concentrating too much capital in a single investment.

Due Diligence: Conduct thorough due diligence before investing. This involves researching the startup, its market, competition, and financials. Seek expert advice if necessary.

Risk Tolerance: Be honest about your risk tolerance. Don’t invest more than you can afford to lose. High-risk investments should only constitute a portion of your overall portfolio.

Exit Strategy: Have a clear exit strategy in mind. Know when and how you plan to exit an investment if it doesn’t perform as expected.

Stay Informed: Continuously monitor your portfolio companies and the broader market. Be prepared to adapt your strategy if necessary.

Investment Vehicles:

There are various ways to invest in venture capital, each with its own pros and cons. Understanding these investment vehicles is crucial:

Venture Capital Funds: These are managed by professional fund managers who invest in a diversified portfolio of startups. It’s a passive way to invest in VC and provides diversification.

Angel Investing: Angel investors directly invest their capital in startups. This approach offers more control and the opportunity to actively mentor portfolio companies.

Crowdfunding Platforms: Online platforms like Kickstarter or equity crowdfunding platforms allow you to invest smaller amounts in startups. It’s a way to access early-stage investments without a large capital commitment.

Corporate Venture Capital (CVC): Some corporations have their own venture capital arms. Investing through CVC can provide strategic advantages and access to a corporation’s resources.

Secondary Markets: In some cases, you can invest in existing venture capital investments on secondary markets. This provides liquidity but may come with a premium or discount to the original investment value.

Nurturing Your Portfolio:

Investing in venture capital isn’t a passive activity. To maximize your chances of success, you should actively nurture your portfolio:

Provide Support: Actively engage with your portfolio companies. Offer mentorship, strategic guidance, and introductions to your network to help them succeed.

Attend Shareholder Meetings: Stay involved in the decision-making processes of the startups you’ve invested in. Attend shareholder meetings and provide input when necessary.

Keep Learning: The venture capital landscape is constantly evolving. Continue to educate yourself about emerging trends, technologies, and market shifts that may impact your investments.

Adapt Your Strategy: Be willing to adapt your investment strategy as circumstances change. This may involve increasing or decreasing your exposure to venture capital based on your portfolio’s performance and your evolving financial goals.

Conclusion:

Investing in venture capital can be a rewarding endeavor, but it comes with risks and challenges. To succeed in this asset class, you must assess your risk tolerance, educate yourself, build a strong network, diversify your portfolio, and choose the right investment vehicle.

Conduct thorough due diligence and be prepared for the long-term nature of these investments. By following these steps and staying informed, you can unlock the potential for significant returns and participate in the growth of innovative startups.

Remember, venture capital is not for the faint of heart, but for those willing to take the risk, the rewards can be substantial.