How To Calculate Return On Investment (ROI)

Return on Investment (ROI) is a crucial financial metric used by individuals, businesses, and investors to evaluate the profitability of an investment or project.

Whether you’re considering investing in stocks, real estate, a business venture, or even making improvements to your home, ROI can help you make informed decisions.

In this article, we will explore what ROI is, why it matters, and how to calculate it.

What is Return on Investment (ROI)?

ROI is a measure of the profitability of an investment relative to its cost. It allows you to assess the efficiency of your investments and make comparisons between different opportunities. A positive ROI indicates that your investment has generated a profit, while a negative ROI signifies a loss.

Why is ROI Important?

Informed Decision-Making: ROI helps you make well-informed decisions by quantifying the potential return on a particular investment. This enables you to prioritize investments with the highest expected return.

Risk Assessment: ROI also factors in the element of risk. An investment with a higher ROI may carry higher risk, so you can weigh the potential return against the associated risk.

Performance Evaluation: For businesses, ROI is a critical tool for evaluating the success of projects, marketing campaigns, or overall company performance.

Comparison Tool: ROI enables you to compare investments with different time horizons, making it easier to determine which investments will provide the best long-term gains.

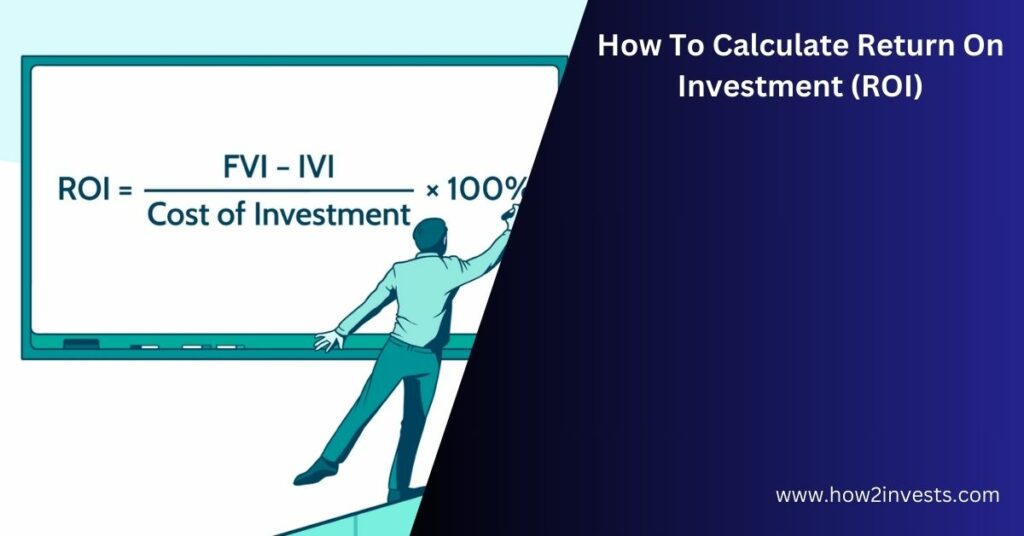

Calculating ROI:

The basic formula for calculating ROI is:

ROI = (Net Profit / Cost of Investment) x 100

Let’s break down the components of this formula:

Net Profit: This represents the income generated from the investment minus all associated costs. It includes both the initial investment cost and any ongoing expenses.

Cost of Investment: This includes the total cost of acquiring and maintaining the investment, including purchase price, fees, taxes, and ongoing expenses like maintenance, insurance, and management costs.

Multiply the result by 100 to express ROI as a percentage:

Example:

Suppose you invest $10,000 in stocks, and after a year, your investment has grown to $12,000. During that time, you incurred $500 in trading fees and $200 in taxes. To calculate ROI:

Net Profit = ($12,000 – $10,000) – ($500 + $200) = $1,300

Cost of Investment = $10,000 + $500 + $200 = $10,700

ROI = ($1,300 / $10,700) x 100 ≈ 12.15%

In this example, your ROI is approximately 12.15%, indicating that your investment generated a profit of 12.15% relative to its initial cost.

Types of ROI Calculations:

Basic ROI: This is the standard formula mentioned earlier, which calculates ROI as a simple percentage based on the net profit and cost of investment. It’s widely used for straightforward investments.

Time-Adjusted ROI: This formula takes into account the duration of the investment. It calculates the annualized ROI, making it useful for comparing investments of different durations.

Risk-Adjusted ROI: This type of ROI adjusts for the level of risk associated with an investment. It’s particularly valuable for evaluating investments with varying degrees of risk and helps you make decisions that align with your risk tolerance.

Social ROI: Used primarily by nonprofit organizations, this ROI calculation assesses the social and environmental impact of an investment rather than financial returns. It’s a way to quantify the broader benefits of socially responsible investments.

Challenges in Calculating ROI:

Data Accuracy: Accurate ROI calculations depend on precise data, both in terms of costs and returns. Inaccurate or incomplete data can lead to misleading ROI figures.

Time Frame: Choosing the right time frame for ROI calculations can be challenging. Short-term ROI may be higher, but long-term ROI might provide a more accurate representation of an investment’s success.

Intangible Returns: Some investments, like brand-building or employee training, may not generate immediate monetary returns. Assessing the value of intangible benefits can be complex.

Opportunity Cost: ROI calculations often ignore the concept of opportunity cost, which refers to the potential returns lost by choosing one investment over another. This can affect the accuracy of ROI assessments.

Interpreting ROI Results:

Positive ROI: A positive ROI indicates that your investment has generated a profit. However, a higher ROI doesn’t always mean a better investment; it should be evaluated in the context of your financial goals and risk tolerance.

Negative ROI: A negative ROI signifies a loss on your investment. It’s essential to analyze why an investment resulted in a negative ROI and whether it’s due to temporary factors or underlying issues.

ROI Thresholds: Different individuals and organizations may have different ROI thresholds based on their financial goals and risk tolerance. Knowing your ROI threshold can help you determine whether an investment aligns with your objectives.

Comparing Investments: When evaluating multiple investment opportunities, comparing their ROIs can be helpful. However, it’s crucial to consider other factors like risk, time frame, and liquidity before making a decision.

Improving ROI:

Cost Management: Reducing investment costs can directly improve ROI. This includes minimizing fees, negotiating better terms, and optimizing operational expenses.

Revenue Enhancement: Increasing revenue or income generated by an investment can boost ROI. Strategies may include expanding sales channels, improving product quality, or enhancing marketing efforts.

Risk Mitigation: Reducing the risk associated with an investment can enhance ROI. Diversification, hedging strategies, and proper due diligence can help protect your investment.

Continuous Monitoring: Regularly tracking the performance of your investments allows you to make adjustments as needed. Monitoring ROI helps you identify trends, spot issues early, and seize opportunities for improvement.

Conclusion:

Return on Investment is a powerful tool for assessing the profitability and efficiency of investments, projects, and business activities. By calculating ROI, you can make more informed financial decisions, allocate resources effectively, and evaluate the success of your endeavors.

Whether you’re a seasoned investor or a business owner, understanding how to calculate ROI is essential for achieving your financial goals.

Also Read:

- Unlocking Opportunities Käntäjää: The Translator Investment Advantage

- Unveiling the Käntäj Investment Plan: A Roadmap to Financial Success

- Kääbntäjä : A Guide to Money Investment”

- How Are Bozullhuizas Partners Ltd? Business Model, Services, and Reputation

- Unveiling the Mystery: The Enigmatic World of 2045996879